Presentation and history

AIM Italia/Mercato Alternativo del Capitale is a Multilateral Trading Facility (MTF) dedicated to small and medium-sized Italian companies with high growth potential, regulated and managed by Borsa Italiana and inspired by a similar English initiative.

It was created to facilitate the listing of the shares of small and medium-sized companies, allowing streamlined procedures and short times.

AIM Italia was launched in Italy in 2009 and has been borrowed from the experience and know-how gained in over 15 years of experience of the London Stock Exchange's AIM UK.

From March 1, 2012 AIM Italia was merged with the pre-existing MAC and AIM Italia / Alternative Capital Market was born, with the aim of rationalizing the offer dedicated to SMEs (Small and Medium Enterprises) and propose a single market designed for the most dynamic and competitive SMEs in our country, offering them the opportunity to access a new financial source, independent from the banking system.

AIM is an unregulated market, therefore it is not subject to specific regulations relating to the organisation and operation of the market itself.

The absence of regulation means that the operation of the market, the securities and the operators admitted are not subject to the specific discipline and authorization of the Supervisory Authorities on Regulated Markets and are not registered in the appropriate register.

Therefore during the admission phase there is no investigation by Consob (Commissione Nazionale per le Società e la Borsa).

In consideration of the flexibility and rapidity of access, the figure of the Nominated Adviser (Nomad) acquires particular relevance. The Nomad is the person responsible to Borsa Italiana, in charge of assessing the appropriateness of the company for admission and then assisting, guiding and accompanying it throughout the period of its stay on the market.

Why list?

Listing one's shares on the stock exchange is primarily a means of finding available capital to finance corporate growth without going through traditional banking channels.

Listing one's shares on the stock exchange is primarily a means of finding available capital to finance corporate growth without going through traditional banking channels.

|

| The stock exchange bell announcing the new listing |

Opening to the capital market also contributes to:

- Expand and diversify funding sources;

- Increase bargaining power with banks;

- Raise financial resources to be used in dimensional development plans;

- Finance acquisitions, including through share swaps;

- Strengthening of the productive structure;

- Commercial strengthening;

- Give an objective and transparent value to the company;

- To give flexibility and liquidity to the shareholder base by allowing shareholders who are no longer motivated to liquidate all or part of their shareholding (exit strategy);

- Expand the shareholding structure;

- Facilitate generational transition;

- Involve management in the results of the business by having them share in the capital;

- Introduce incentive plans for management and employees;

- Increase the standing and visibility of the firm to clients and suppliers;

- Expand your network of business relationships and attract qualified resources;

- Strengthen the company's credibility through the presence of qualified investors;

- Increase corporate bargaining strength in negotiations.

SMEs are the backbone of the Italian economy.

In numerical terms, SMEs provide around two thirds of the added value of the entire industrial sector and employ 80% of the total workforce.

AIM Italia offers small and medium-sized companies the possibility of efficiently accessing a selected audience of investors focused on small caps, offering a faster and more flexible path to listing than the main market (MTA), in line with the growth rates of SMEs.

|

| Source: Francesco M. Renne |

There are bureaucratic and communication facilities that reduce costs for companies and speed up the listing process.

More specifically, the facilities refer to the exemption from the obligation to publish an initial prospectus and quarterly management reports.

Listing on AIM Italia can be an effective way to finance the growth and development of an SME.

AIM Italia is designed to offer SMEs a combination of listing advantages, with a path that is characterized by:

- Regulatory flexibility for SMEs: AIM Italia is based on flexible regulations, designed to offer a simplified path to listing and at the same time post-listing requirements calibrated to the structure of small and medium-sized companies;

- The admission requirements are reduced compared to those required for listing on the main markets. There is no minimum size of the company in terms of capitalization and, as far as the free float is concerned, a minimum threshold of 10% is sufficient. There are no particular requirements in terms of corporate governance, nor are there any specific economic or financial requirements. It is the market itself, through the figure of the Nomad, that defines the ideal characteristics of the companies that will be admitted to the market;

- Speed of access: access requirements are simplified compared to the main market and less stringent to allow a greater number of companies to be able to list;

- Low listing costs compared to listing on a regulated market: the lower costs are a consequence of the greater regulatory flexibility and speed of listing;

- International visibility: being part of the offer of a market management company such as Borsa Italiana, and directly deriving from a successful experience such as that of AIM in London, companies access a global market and benefit from international visibility.

However, listing on the stock exchange requires commitment from the company and its managers to comply with regulations and commitments.

Listing on AIM Italia is a key choice for the future of SMEs because it offers a solution to increasingly complex competitive scenarios that require capital to implement growth projects, strategic vision, visibility to generate competitive advantages and capital strengthening.

AIM Italia allows direct access to stock markets with a simplified listing process for business development.

It has established itself over the years as a privileged channel for SMEs to finance important development projects.

The success factors of AIM Italia

The factors that have contributed to the success of AIM Italia are:

- the concrete possibility of access to the stock market for companies with limited turnover;

- lower requirements and shorter timeframes for admission to listing compared with the MTA regulated market;

- a simplified and balanced IPO (Initial Public Offering) process that aims to facilitate the gradual transition of an SME to the status of a listed company;

- lower costs and compliance during the period of stay on the market;

- a diversified and international investor base with medium-term investment prospects;

- a reduction in the dependence of SMEs on the credit system.

AIM Italia is the right instrument for SMEs that intend to raise financial resources with a clear growth project and presents interesting opportunities:

- Tax savings: the Budget Law 2018 approved the tax credit on 50% of consulting costs related to the IPO incurred for the listing of SMEs on the stock exchange until December 31, 2020, for a maximum of 500 thousand euros per company.

- PIR liquidity: following the introduction, in the 2017 Budget Law, of PIRs (Individual Savings Plans) and the emergence of numerous funds specializing in Small/Mid Caps, AIM Italia has experienced a significant increase in liquidity.

- Enhancement of innovation: AIM Italia is the only unregulated market that can host Innovative SMEs with potential tax incentives for investors.

In addition, in order to stimulate the progressive growth path of a listed company, mechanisms for switching between the various Borsa Italiana listings are provided for, which help the company to optimize the efforts made during the listing phase.

Companies that have been listed on AIM Italia for at least 18 months can make the transition to the main market (MTA) with reduced requirements compared to the regular direct access procedures.

The operators involved

The entire listing process (IPO) and the subsequent phases are handled by a financial advisor called Nomad (Nominated Adviser) who is in charge of assessing the company's requirements for admission and then assisting, guiding and accompanying it for the period it remains on the market.

In addition to the Nomad there are other key figures of intermediaries who intervene in the initial listing process and subsequently when the company is already listed.

Role and characteristics of each operator are defined by the regulation establishing Aim Italia.

The nominated advisor has a priority role because it performs those functions that enable the smooth functioning of the market as a whole and protect its reputation and integrity

Nomad

The nominated advisor has a priority role because it carries out those functions that allow the good functioning of the market as a whole and protect its reputation and integrity.

The Nomad:

- Evaluates the suitability and adequacy of the company for admission;

- ensures compliance with the formal pre-listing requirements and execution of the requirements and procedures on AIM Italia;

- performs a valuation of the company and performs Due Diligence;

- check the Business Plan;

- prepare the Information Memorandum and the Admission Document;

- manages the listing process, defining the timeline.

The regulations state that Nomad can be:

- A professional association or corporation known to the market and with adequate professionalism: therefore, investment banks, brokers, professional associations, but not individuals, can play this role;

- must have engaged in corporate finance activities for an appropriate period of time, normally at least two years, and have adequate experience having conducted a number of material transactions;

- have a sufficient number of employees to perform the required activities;

- have key executives with appropriate professionalism;

- have adequate controls and procedures in place to comply with Nomad regulations.

The Nomad may also serve as Global Coordinator and Specialist.

Nomad List:

Global coordinator

Financial Advisor

Legal Advisor

Specialist

Financial Analyst

Fiscal Advisor

The Fiscal Advisor performs fiscal due diligence for the Nomad through the analysis of the accounting and fiscal situation of the company, the verification of the conformity of the Balance Sheet and Profit and Loss Account with the civil and fiscal regulations, the verification of the regularity of the accounting books.

- Integrae SIM

- EnVent Capital Markets

- Banca Bank

- BPER Bana

- Alantra

- CFO SIM

- Banca Profilo

- Intesa Sanpaolo - UBI Banca

- Banca Akros

- Equita SIM

- Banca Intermobiliare

- Banca Mediolanum

- Baldi Finance

- Fidentis Equities

- MPS Capital Services

- illimity Bank

The Global coordinator is an important figure for the success of the listing process.

He identifies, together with the Financial Advisor and the company, the target and the type of investors.

Its main function consists in the placement to institutional and/or retail investors (if any) of the listed shares, sponsoring the issuing company towards the financial community and coordinating the whole listing operation.

Its duties are:

- organisation of meetings with institutional investors, during which details and reasons for investing in the company's shares are explained, the so-called roadshow, a period in which management meets potential institutional investors;

- taking care of the entire marketing process together with the financial communication company (publications, management presentation, etc.);

- definition, together with the Nomad and the financial advisor, of the value of the issuing company;

- bookbuilding activities, consisting in the collection of orders from institutional investors;

- pricing activities, where the offer price of the shares placed is precisely defined on the basis of the feedback obtained during the roadshow.

Global Coordinator List:

- Integrae SIM

- EnVent Capital Markets

- Alantra

- Intesa Sanpaolo - IMI - UBI Banca

- Equita SIM

- Banca Profilo

- BPER Banca

- illimity Bank

The Financial Advisor is the independent expert in capital markets and corporate finance that supports the SME in the listing project.

The financial advisor has a particularly important role because he is the entrepreneur's interface with all the interlocutors in the listing process and is often identified before them.

Especially for small and medium-sized companies, the financial advisor intervenes before the process begins and introduces those changes in the company that are essential to prepare the company in the most correct way for the process:

- implements the management control system and tests its effectiveness;

- assists the company and its management in the drafting of the business plan and the identification of key business variables;

- It helps in identifying a value for the company on the basis of which the entrepreneur can orient himself when comparing himself in the initial and subsequent phases up to placement with other market players;

- assists the SME in the overall organization of the operation and in the definition of the structure on the basis of the financial requirements; selects the IPO team and coordinates the different actors in the project.

Financial Advisor Directory:

- 4AIM SICAF

- AC Finance

- Ambromobiliare

- Arkios Italy

- Caretti e Associati

- Emintad Italy

- Ginini Antipode

- IR Top Consulting

- Studio Alloisio e Associati

They have the task of advising their clients on all aspects concerning legal and contractual terms, both towards Borsa Italiana and towards the other parties involved in the listing.

The company's legal advisors have the task of:

- Advise the company on the legal aspects of the transaction;

- assist you in defining the structure of your offering, the optimal corporate structure and any corporate restructuring (for example, the creation of a holding company);

- review the admission document and other documents required for listing purposes;

- carry out legal due diligence, issue legal opinions, assist the Nomad in preparing and issuing the declarations to Borsa Italiana required by the AIM Italia Regulations;

- where requested by the Nomad and if necessary, to examine in depth aspects relating to corporate governance;

- inform the directors of their responsibilities, as defined both in the admission document and following the granting of the status of company admitted to AIM Italia;

- assist the company in the definition of contracts with the other parties involved in the listing process, the Nomad and the broker, and regarding the placing agreement. They review the admission document and any other documents and information that could result in liability for their clients.

Legal Advisor Directory:

- Gianni Origoni Grippo Cappelli & Partners

- Gitti and Partners

- Studio Legale Grimaldi

- Studio Legale LCA

- Legance - Legali Associati

- Ls Lexjus Sinacta

- Norton Rose Fulbright

- Studio legale Pedersoli

It is compulsorily provided for by the AIM Italia regulations, in order to guarantee the liquidity of the securities, once the company is admitted to trading.

The specialist essentially has the task of carrying out the activity of market maker: buying securities when the market sells and selling them when the market buys.

He undertakes to support the liquidity of the security and to continuously expose to the market buy and sell proposals at prices that do not deviate from each other by more than an agreed maximum and for a fixed daily quantity.

Specialist Directory:

- Banca Finnat

- Integrae SIM

- MIT SIM

- Intesa Sanpaolo - IMI - UBI Banca

- Banca Akros

- Bana Profilo

- CFO SIM

- Intermonte SIM

- BPER Banca

- Equita SIM

- Mediobanca

- Mainfirst Bank

- Banca Intermobiliare

- Invest Banca

Usually the specialist himself, or another person appointed by him, has the task of periodically preparing studies and research on the listed company to be made available to investors, who may thus be aware of the company's performance and future strategies, and to promote awareness of the company on the stock market.

They are normally published twice a year when the annual and semi-annual results are approved.

In the pre IPO phase, the research is preparatory to the listing: the financial, industrial and market analysis on the company being listed supports the feasibility of the IPO project and the evaluation process.

In the post-listing phase, equity research enhances the value of the SME as an investment opportunity, contributes to the liquidity of the stock, leading to greater interest from investors, reducing volatility and supporting new transactions for further capital raising.

The Fiscal Advisor performs fiscal due diligence for the Nomad through the analysis of the accounting and fiscal situation of the company, the verification of the conformity of the Balance Sheet and Profit and Loss Account with the civil and fiscal regulations, the verification of the regularity of the accounting books.

Auditing firm

It is in charge of verifying the Financial Statements and recording management events in the accounting records, carrying out auditing and certification of historical financial information.

Investor Relations and Press Office

Investor Relations (IR) includes all activities through which the listed company communicates with its current or potential investors, in compliance with the information obligations imposed by the regulations.

The Investor Relations activity is fundamental to guarantee the success of the IPO operation and to promote PMI as an investment opportunity towards institutional investors.

With the listing on AIM Italia a continuous confrontation between the management and the investors opens up, in which the construction of the equity story and the management of the IR activity are strategic to enhance the value of the company and ensure the liquidity of the securities listed on AIM Italia.

Small and medium capitalization companies make use of the support of external Investor Relations experts.

The main objective of the IR activity is the correct valuation of the stock.

The phases of the listing

Preparatory activities:

- Select the Nomad and consultant team;

- Initiate due diligence;

- Building the equity story and investor relations strategy.

3 months:

- Verify problem areas that emerged from due diligence;

- Prepare the draft admission document;

- Share initial assessment hypotheses;

- Analyst Presentation.

1 - 2 months:

- Complete due diligence and documentation;

- Investor Roadshow;

- Pre-admission notice (10 days in advance).

1 week:

- Completion of application, publication of admission documents and placement of the offering (3 days prior);

Admission requirements

The admission procedure to the market and the ongoing obligations during trading are defined by the AIM Italia Issuers' Regulations.

In particular, there are no minimum requirements in terms of capitalization, corporate governance or specific economic and financial requirements.

Since the assessment of appropriateness is delegated to the Nomad, it will be the market, through the Nomad, to define the ideal characteristics of the admitted companies and the related governance controls.

With the passage of time, on the other hand, a market practice has developed that requires companies to present a minimum turnover linked to their business model and minimum governance controls to protect the market.

For the success of the IPO, it is necessary to attract the interest of investors.

The company must demonstrate that it can create value in the future and must meet a series of substantive and formal requirements.

Substantive requirements

The decision to go public is closely linked to the strategic growth project, which cannot disregard the track record and future sustainability of the business model.

The feasibility of IPO involves the verification of the substantive requirements that attract the attention of Investors:

- The strategic, organizational, financial characteristics:

- the competitive and market environment;

- the key drivers that determine the success of the company.

A number of substantive requirements should be met by the company:

- Track record of success;

- sustainable business plan;

- value creation orientation;

- industry with opportunities for growth;

- solid competitive positioning;

- market leadership;

- management expertise;

- orientation towards internationalization;

- management autonomy;

- balance of the financial structure;

- solid fundamentals and high margins;

- management organization;

- openness to communication;

- capacity for innovation.

Unlike the main MTA list, AIM Italia is characterized by a simplified admission process as there are no minimum requirements for admission in terms of capitalization, turnover or corporate governance structure.

The main requirements and documents required are listed below.

Formal requirements at the admission stage

Appointment of a Nomad: the presence of the Nomad must be continuous both during the admission phase and during the trading of the security on the market, without interruption.

Minimum free float of 10%: this requirement is met if the shares are distributed to investors who are not related parties or employees of the company or the reference group, as a result of a placement to be made at the same time as or close to admission to trading on the market.

By "proximity" is meant no later than two months after admission.

The IPO transaction can basically be structured in 3 ways: OPS, OPVS, OPVS.

- OPS - The Board of Directors resolves to place newly issued shares on the market, thereby increasing the share capital.

- OPV - Offer for public sale of a portion of the property through the release of existing corporate shares to the market.

- OPVS - Joint use of the two methods with sale by existing shareholders and simultaneous issuance of new shares.

At least 5 institutional investors: for an amount consistent with the overall amount of the placement

An institutional investor is an economic operator (company or entity) that makes substantial investments in a systematic and cumulative manner, having at its disposal considerable financial possibilities of its own or entrusted to it:

- insurance companies;

- asset management company;

- credit institutions or other professional financial operators acting on their own behalf or as part of a mandate on behalf of their clients, including private individuals;

- collective investment schemes, such as investment funds or pension funds;

- territorial public bodies;

- financial holding companies.

The requirement that institutional investors be present during the placement phase is a guarantee that the initial valuation of the company is fair and based on objective considerations.

Retail investor consists of all private investors who do not fall within the definition of institutional investor.

Any offer reserved for retail investors has a maximum amount of 5 million euros.

At least one financial analyst covering the company.

Admission document: the admission document must contain information on the company's activity, management, shareholders and economic-financial data.

The structure of the document follows the model foreseen for the prospectus foreseen by Regulation 809/2004/EC although it contains a smaller number of information and not all the chapters foreseen for a normal prospectus.

Corporate financial statements: the company must have the latest financial statements, certified by a legal auditor and drawn up according to Italian national principles or IAS/IFRS.

A minimum number of closed financial statements is not required.

Company by-laws: companies are required to adapt their by-laws by making applicable by reference to the provisions relating to listed companies set out in the TUF and CONSOB implementing regulations on compulsory purchase and exchange offers, limited to articles 106 and 109 of the TUF.

However, since the company itself has to be suitable for being listed on a stock exchange and present suitable features to make it attractive to external investors, it is now market practice that at least one independent director is present and that the members of the Board of Statutory Auditors are completely independent, in accordance with the provisions of the self-regulatory code.

Dematerialised and freely transferable shares: the company's shares must be dematerialised at Monte Titoli S.p.A. in order to allow for settlement procedures.

Ongoing formal requirements

The research must be published on the website of Borsa Italiana as soon as possible and in any case no later than one month after the approval of the accounting data.

Also this person, like the Nomad, must be maintained without interruption.

Appointment of an SDIR: the AIM Italia issuer must appoint an SDIR (Sistema di Diffusione delle Informazioni Regolamentate - System for the Dissemination of Regulated Information) to ensure that the information provided for in the regulations is disclosed in the manner and within the timeframe required by the relevant regulations.

Publication of the annual financial statements and the half-yearly report: preparation and publication of the annual financial statements presented in compliance with Italian Accounting Standards or International Accounting Standards (audited) within 6 months of the end of the financial year.

Preparation and publication of the half-year reports within 3 months of the end of the accounting period.

There is no obligation to publish quarterly reports.

The annual financial statements must be audited, while the half-yearly reports do not have to be audited, although market practice dictates that they be subjected to a limited review.

Accounting information can only be prepared in Italian, as preparation in English is optional.

Publication of price-sensitive information: i.e. information that could have an impact on future results and on the performance of the stock.

Their disclosure is regulated by the MAR (Market Abuse Regulation).

Events of a financial or institutional nature that occur in the issuer's sphere of activity and are capable of generating effects on the share price must be communicated to the public while ensuring information symmetry.

Maintaining a website: it is mandatory to have a website on which to insert an Investor Relations section where information relating to the description of the business, names and responsibilities of the members of the administrative body, articles of association, number of financial instruments, financial statements, press releases issued in the last five years, admission document, information on the Nomad and significant shareholders is made available.

Investor relations adviser: it is not mandatory on AIM to appoint an investor relations adviser.

However, for market practice and in order to better manage the relationship with the market, it is recommended to appoint a person, also external to the company, to occupy the position of Investor Relator.

Frequently asked questions

Company by-laws: companies are required to adapt their by-laws by making applicable by reference to the provisions relating to listed companies set out in the TUF and CONSOB implementing regulations on compulsory purchase and exchange offers, limited to articles 106 and 109 of the TUF.

Minimum requirements for corporate bodies: according to the regulations, no minimum requirements are provided for with regard to the composition of corporate bodies.

However, since the company itself has to be suitable for being listed on a stock exchange and present suitable features to make it attractive to external investors, it is now market practice that at least one independent director is present and that the members of the Board of Statutory Auditors are completely independent, in accordance with the provisions of the self-regulatory code.

Dematerialised and freely transferable shares: the company's shares must be dematerialised at Monte Titoli S.p.A. in order to allow for settlement procedures.

Ongoing formal requirements

Appointment of a specialist: a person who will have the task of supporting the liquidity of the security once trading has started and will have the obligation to produce, or have produced, at least two research reports per year concerning the issuer on the occasion of the publication of the annual and half-yearly results.

The research must be published on the website of Borsa Italiana as soon as possible and in any case no later than one month after the approval of the accounting data.

Also this person, like the Nomad, must be maintained without interruption.

Appointment of an SDIR: the AIM Italia issuer must appoint an SDIR (Sistema di Diffusione delle Informazioni Regolamentate - System for the Dissemination of Regulated Information) to ensure that the information provided for in the regulations is disclosed in the manner and within the timeframe required by the relevant regulations.

Publication of the annual financial statements and the half-yearly report: preparation and publication of the annual financial statements presented in compliance with Italian Accounting Standards or International Accounting Standards (audited) within 6 months of the end of the financial year.

Preparation and publication of the half-year reports within 3 months of the end of the accounting period.

There is no obligation to publish quarterly reports.

The annual financial statements must be audited, while the half-yearly reports do not have to be audited, although market practice dictates that they be subjected to a limited review.

Accounting information can only be prepared in Italian, as preparation in English is optional.

Publication of price-sensitive information: i.e. information that could have an impact on future results and on the performance of the stock.

Their disclosure is regulated by the MAR (Market Abuse Regulation).

Events of a financial or institutional nature that occur in the issuer's sphere of activity and are capable of generating effects on the share price must be communicated to the public while ensuring information symmetry.

Maintaining a website: it is mandatory to have a website on which to insert an Investor Relations section where information relating to the description of the business, names and responsibilities of the members of the administrative body, articles of association, number of financial instruments, financial statements, press releases issued in the last five years, admission document, information on the Nomad and significant shareholders is made available.

Investor relations adviser: it is not mandatory on AIM to appoint an investor relations adviser.

However, for market practice and in order to better manage the relationship with the market, it is recommended to appoint a person, also external to the company, to occupy the position of Investor Relator.

Frequently asked questions

Can a company owned by a family be listed?

Yes, in most cases AIM companies are held by families of entrepreneurs.

Family control is the distinctive element that constitutes the Italian entrepreneurial fabric.

Most AIM Italia companies were held by families at the time of listing.

Do you lose control of your company with the listing?

No, a limited free float (10%) is required to list on AIM Italia.

The family continues to hold control of the company in most cases and the average free float at IPO is 23%.

Can you run your company without being influenced by third parties once you are listed?

Yes, the majority shareholders define the strategy, but the market must be informed in a timely manner of the choices that may affect the stock.

Investors specialized in investing in SMEs generally hold small stakes and adopt medium/long-term investment horizons.

Can small and medium-sized companies be listed?

Yes, turnover size is not a requirement for admission; the elements appreciated by investors are high growth rates, good profitability and a sustainable business plan in the medium to long term.

50% of the companies listed on AIM Italia, at the time of the IPO, have a turnover of less than 10 million euros.

The capitalization of companies listed on AIM Italia at the time of listing is between 10 and 100 million.

Can SMEs on the stock exchange attract foreign institutional investors?

Yes, it is easy to access foreign channels and can be the object of attention of international investors.

Today 76% of institutional investors on AIM Italia are foreign.

Does the market price reflect the value of the company?

The price is the combination of the credibility of the forecasts of the prospective results of the business plan communicated to the market; the interest of investors and the liquidity of the stock, or rather the possibility of a frequent meeting between supply and demand.

Costs

The costs incurred by the Issuer for the listing process on AIM can be divided into three categories: fixed advisory costs, variable placement costs, fixed annual costs.

The costs incurred by the Issuer for the listing process on AIM can be divided into three categories: fixed advisory costs, variable placement costs, fixed annual costs.

Fixed costs

These are a function of the company's structure, size and complexity and include the specific advice required to assess IPO feasibility and support the company through the process, including:

- IPO Feasibility Study;

- Financial Advisory costs to support the entrepreneur in the IPO process;

- Due diligence (financial and business) and Admission Document by the Nomad;

- Opinion on the Company's Financial Statements and Comfort Letter by the independent auditors;

- Management of Financial Communications and Investor Relations by Financial Communications and IR firm;

- Legal and fiscal due diligence;

- Listing fee to Borsa Italiana and Monte Titoli.

In figures it is:

- AIM Italia fees: 20,000 euros,

- Financial advisor: 90,000 - 100,000 euros,

- Nomad: 100,000 - 120,000 euros,

- Specialist: 20,000 euros,

- Auditing firm: 30,000 euros,

- Taxpayer: 10,000 euros,

- Legal and notary fees: 30,000 - 70,000 euros,

- Montetitoli and management of shareholders' ledger: 10,000 euros.

Overall: 310,000 - 380,000 euros

The Budget Law 2018 approved the tax credit on 50% of consulting costs related to the IPO incurred for the listing on the Stock Exchange of SMEs until December 31, 2020, for a maximum of 500 thousand euros per company.

Variable Placement Costs

refer to the placement of the stock on the market and are defined as a percentage of the total capital raised (OPS + OPV).

- Equity placement fees (Global coordinator): 4-6% of IPO value,

- Success fee (Financial advisor): 0.8-1.0% of capitalization.

Variable placement costs are excluded from the tax credit.

Post-quotation costs (annual):

- AIM Italia: 12,600 euros,

- Consob: 5,000 euros,

- Nomad: 30,000 - 40,000 euros,

- Specialist: 25,000 - 35,000 euros,

- Communication and IR companies: 10,000 - 30,000 euros,

- Auditing firm: 15,000 - 20,000 euros,

- Legal fees: 10,000 - 15,000 euros,

- Euronext Securities Milano (ex Montetitoli) and management of shareholders' ledger: 15,000 euros.

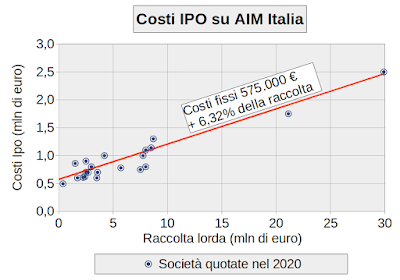

Empirical analysis of all 21 IPOs made on AIM Italia in 2020.

Underpricing

This is the difference (discount) between the placement price of the securities and the quotation recorded on the first day of trading.

While not a monetary cost, but an opportunity cost, it is a relevant factor to consider when discussing IPO costs.

The median discount was, for the last 16 IPOs (2020-21) conducted on AIM Italia, -15.3%, corresponding to a median performance of +18.0% price increase of the new shares on their first day of trading, compared to the placement price.

Aim Italia: Beginner's Guide (19 pages, Pdf format)